Trying to finance a new or used car this year?

Last updated Jan 16th, 2026

What Is APR and Why Does It Matter?

APR is the cost of borrowing money, expressed as a yearly interest rate. It includes the interest rate and any lender fees.

A lower APR means:

- Lower monthly payments

- Less paid over the life of the loan

- More money in your pocket

What’s a Good APR for a Car Loan in 2025?

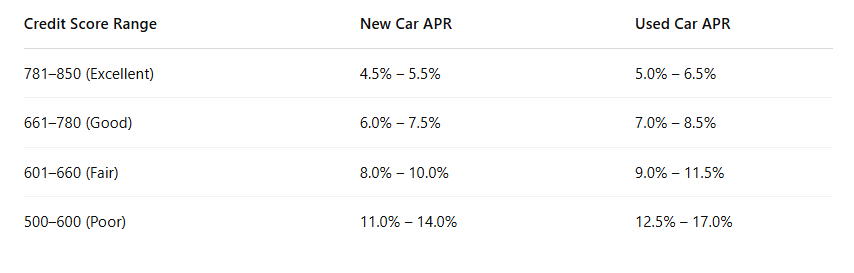

APR rates in 2025 vary based on your credit score, loan term, and whether the car is new or used.

Average APR Ranges in 2025:

💡 Pro Tip: A “good” APR is generally under 6% for new cars and under 7% for used cars—but the better your credit, the better your rate.

Factors That Impact Your APR

Several factors determine what APR you’ll qualify for:

- Credit Score: The biggest factor. Higher scores = better rates.

- Loan Term: Shorter terms usually offer lower APRs.

- Down Payment: A bigger down payment may reduce your interest rate.

- New vs. Used: Loans on new cars often come with lower APRs.

- Lender Type: Credit unions often have lower rates than banks or dealerships.

How to Get a Better Car Loan APR in 2025

Check Your Credit Score First

Know where you stand before you apply. Use free tools or check with your bank/credit union.

Get Pre-Approved

Pre-approval gives you leverage when negotiating with dealers and lenders.

Compare Offers

Don’t settle for the first offer. Shop rates from banks, credit unions, and online lenders.

Use AutoFinder.com to Shop Smarter

Compare car listings, see estimated loan payments, and connect with dealers who offer competitive financing options.

APR FAQs – Quick Answers

Is 0% APR still available in 2025?

Yes—but it’s typically reserved for buyers with excellent credit and on select new models with manufacturer incentives.

Is it better to finance through a dealer or bank?

It depends. Dealers may offer promos, but banks or credit unions often have lower base rates. Compare both.

How does the loan term affect APR?

Longer terms may lower your monthly payment, but they often come with higher APRs and more interest over time.

Ready to Find Your Next Car and Compare Financing?

At AutoFinder.com, you can:

- 🚗 Browse new and used vehicles by price, make, and model

- 💰 Estimate monthly payments based on your credit and APR

- 🏦 Compare financing options from trusted dealers and lenders

👉 Start your search now at AutoFinder.com and get one step closer to the best deal—on the car and the loan!